reverse sales tax calculator bc

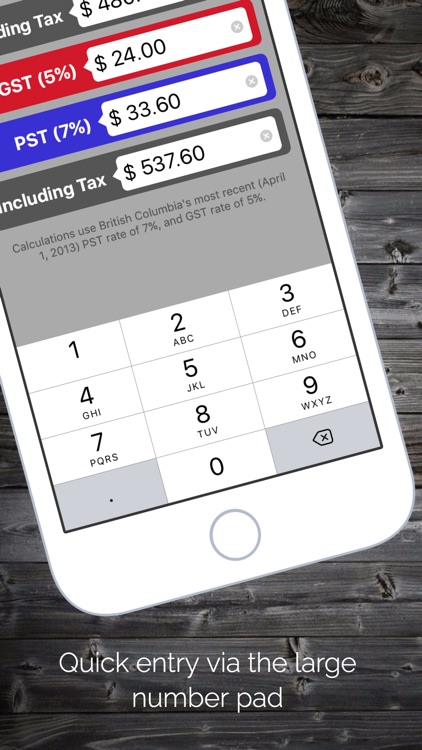

An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. Why A Reverse Sales Tax Calculator is Useful.

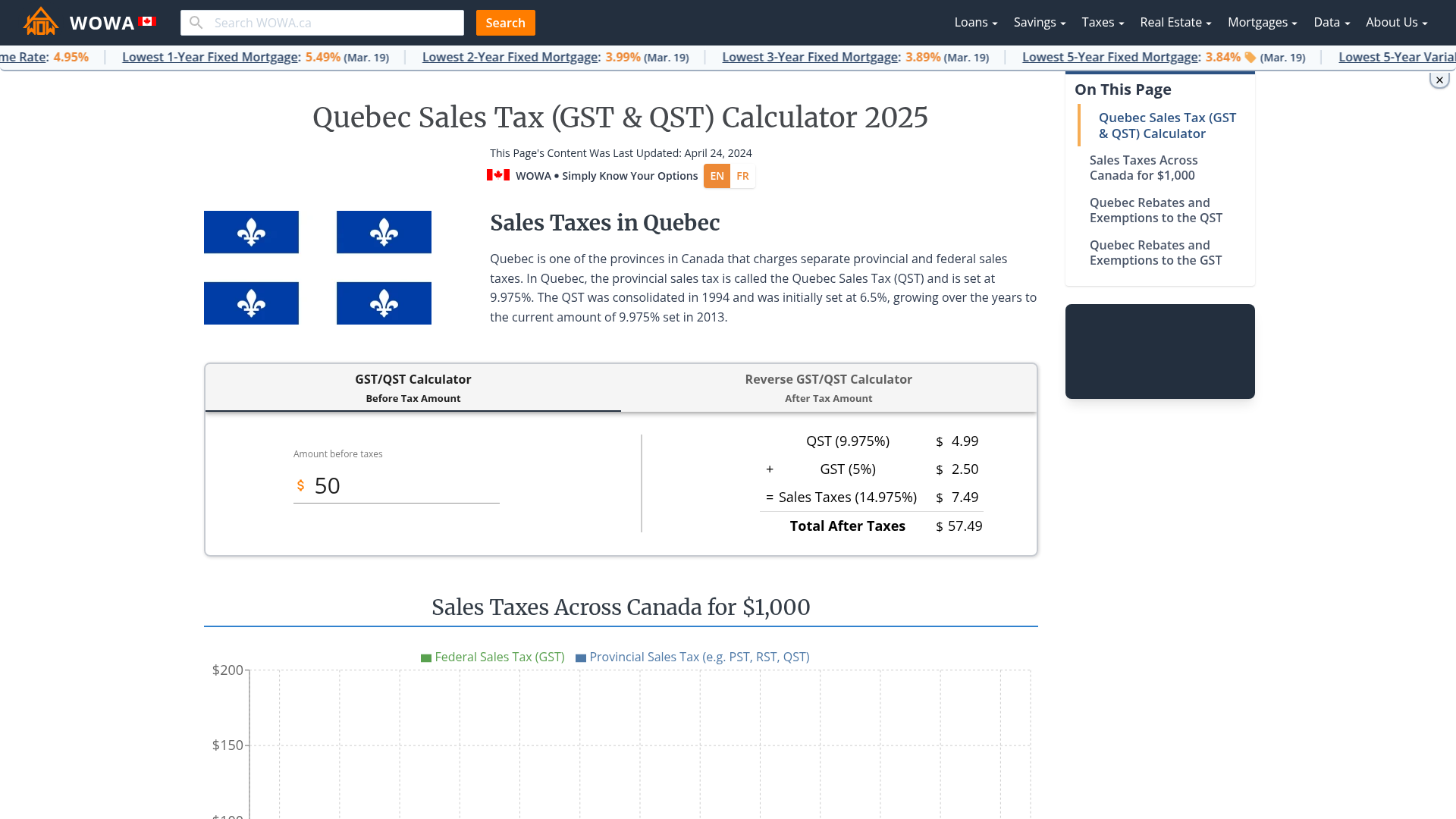

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

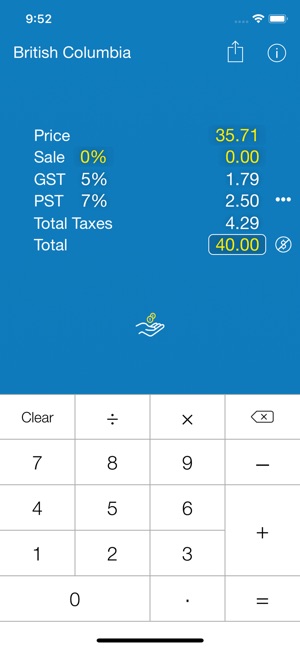

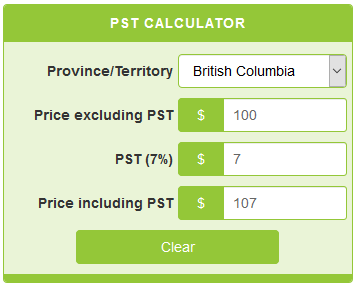

Only four Canadian provinces have PST Provincial Sales Tax.

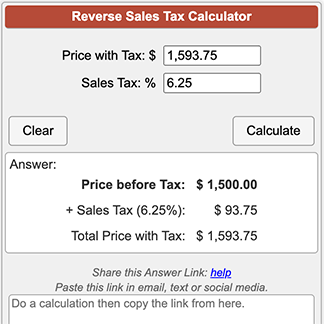

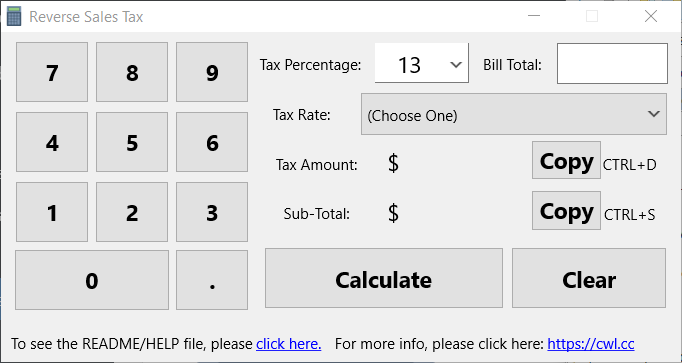

. Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Due to rounding of the amount without sales.

Sales Taxes in British Columbia. Calculates the canada reverse sales taxes HST GST and PST. An online sales tax table for the canadian territories and provinces from year 2012 to 2022.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Using this reverse tax calculator is extremely simple and easy. Sales Tax Calculators Canada Reverse Sales Tax Calculator.

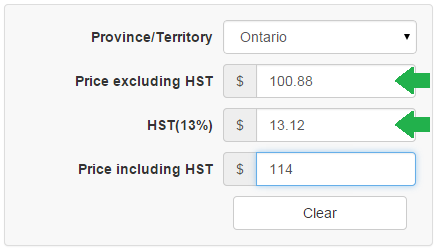

The rate you will charge depends on different factors see. How to use the reverse sales tax calculator. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces.

Divide the price of the item post-tax by the decimal value. Amount without sales tax x HST rate100 Amount of HST in Ontario. Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x.

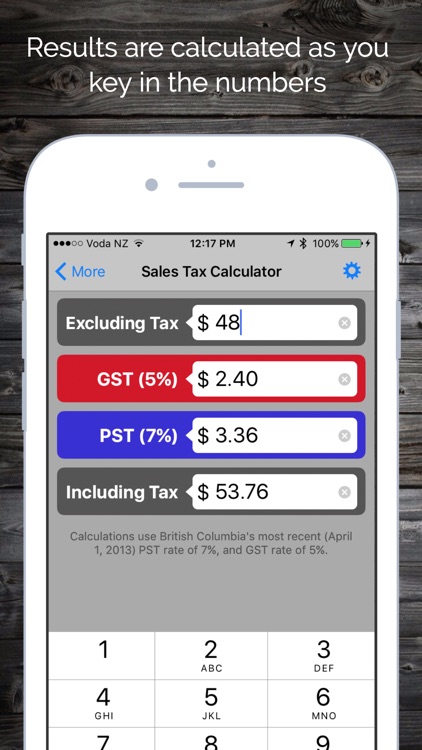

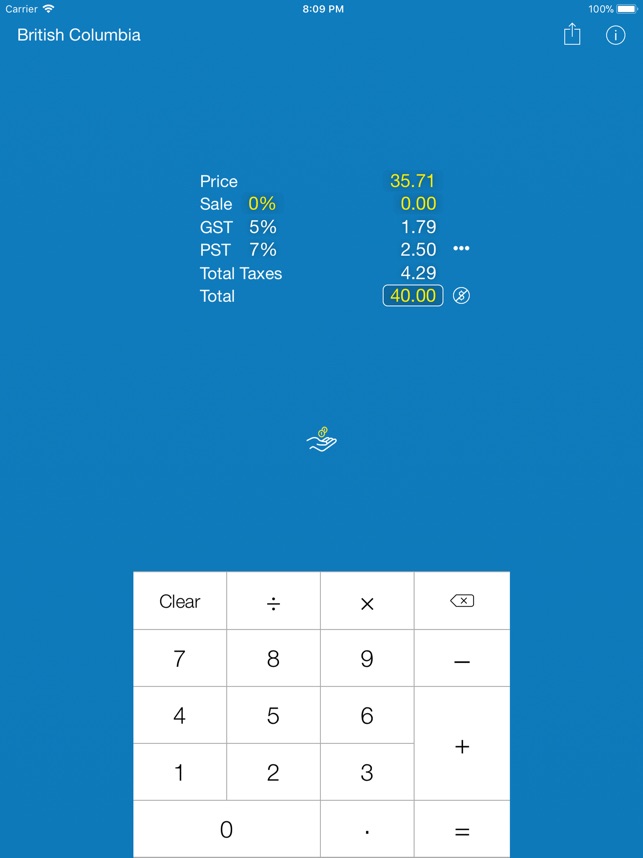

Type of supply learn about what. British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST. Use this online tool whenever you need to check the amount of the items youve.

Margin of error for HST sales tax. In Québec it is called QST. Reverse Sales Tax Calculations.

The following table provides the GST and HST provincial rates since July 1 2010. This tax calculator will help you to know the purchasesell amount before and after tax apply. Before Tax Amount 000.

Useful for figuring out sales taxes if you sell products with tax included. This simple PST calculator will help to. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a. GSTHST provincial rates table. Reverse Sales Tax Formula.

The second tab lets you calculate the taxes from a grand total including tax and gives you the subtotal before tax. If youre selling an item and want to receive 000 after taxes youll need to sell. Here is how the total is calculated before sales tax.

Minus Tax Amount 000. This simple PST calculator will help to calculate PST or reverse PST. British Columbia Manitoba Québec and Saskatchewan.

Formula for calculating reverse GST and PST in BC. Sales Tax Rates Calculator. Plus Tax Amount 000.

Canada Sales Tax Calculator By Tardent Apps Inc

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Canada Sales Tax Calculator By Tardent Apps Inc

Washington Dc Sales Tax Calculator Reverse Sales Dremployee

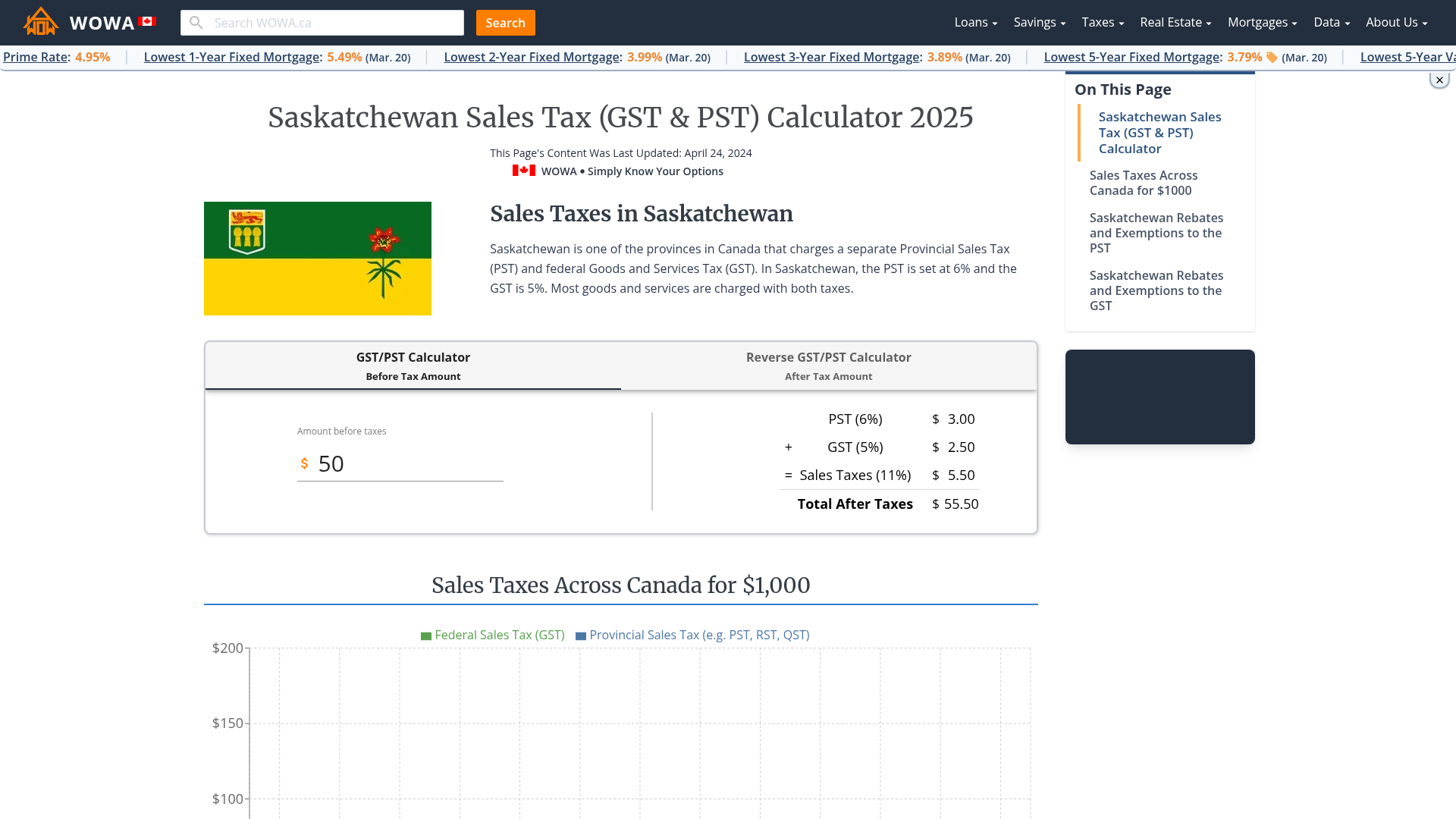

Saskatchewan Gst Calculator Gstcalculator Ca

Sales Tax Canada Calculator On The App Store

Canadian Sales Tax Calculator By Fascinative

Reverse Hst Calculator Hstcalculator Ca

Bc Sales Tax Calculator Hst Gst Pst By Chewy Applications

Sales Tax Canada Calculator On The App Store

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca

Pst Calculator Calculatorscanada Ca